Before I get into this fun little guide on how to DIY file your LLC in New York, a few words from the legal beagles. Woof.

DISCLAIMER:

I am not an attorney. The information provided in this article and on this website does not, and is not intended to, constitute legal advice; instead, all information, content, and materials available here are for general informational purposes only. Information contained in this article may not constitute the most up-to-date legal or other information.

Readers of this article and website should contact their attorney to obtain advice with respect to any particular legal matter. No reader, user, or browser of this site should act or refrain from acting on the basis of information on this site without first seeking legal advice from counsel in their relevant jurisdiction. Only your individual attorney can provide assurances that the information contained herein – and your interpretation of it – is applicable or appropriate to your particular situation.

All liability with respect to actions taken or not taken based on the contents of this site are hereby expressly disclaimed. The content on this posting is provided “as is;” no representations are made that the content is error-free.

And now… on with the show:

For a project that I’ve been working on for the past few months, I’ve finally gotten to the point where it made sense for me to form and file an LLC in New York.

As I’ve noted earlier, I do not at all feel like creating an LLC should be your first step in starting a project or forming a company. I firmly believe that you should be starting with your minimum viable product, getting your feet wet, determining viability, and deciding whether or not this is really something you want to do before you start shelling out your hard-earned dollars to form an LLC in New York (or elsewhere), design a logo, or build a professional website.

With that said, if your motivation is real, your idea is sound, and your project starts finding its wings, you will hopefully get to that point where you need to protect yourself and your assets by forming some sort of corporate entity that separates you the individual from the business you’re building.

I am not going to spend any time here parsing through the differences between LLCs, partnerships, C-Corps, S-Corps, or any of the other business structures that exist out there. With that said, for many ventures an LLC is all you’ll need; which is good because it’s pretty simple and cheap to get started.

Should you seek an actual attorney’s help on this? YES! Read my disclaimer. I am just some dope sitting at his kitchen table, clacking away at a keyboard.

With that said, hypothetically, if you wanted to file your LLC in New York on your own, is it possible? Yes. Is it difficult? Not particularly.

As such, for pure entertainment purposes, in a fictitious world of fairies and gumdrops, here’s a step-by-step process for doing so.

Do with this what you will. I cannot, will not, and should not be held liable for any decisions you chose to do with this information.

So. Here’s what you can do…

Step 1: Before you file your LLC in New York, see if the name is already taken

Make sure there is no company in New York with the same name as what you’re hoping to call your LLC. You can determine this by searching the Corporation & Business Entity Database.

NOTE: The only way to determine a company’s assumed name (i.e., a company’s D/B/A) is by written request.

Step 2: Register your LLC

Once you confirm there is no company registered in the state with the same name, you can register your LLC here.

Step 3: Articles of Organization

Find the section “Articles of Organization Domestic Limited Liability Companies” and click link “Articles of Organization Online Filing.”

NOTE: This may redirect you to a page instructing you to turn off your browser auto-fill settings. If you don’t know how to do that, Google it.

Step 4: Apply as Domestic LLC Owner

Under the section “On-Line Filings for Business Owners”, select “Domestic Limited Liability Company”, which should take you here.

Assuming you are applying for yourself, you’ll select “Apply Online as an Owner.”

Step 5: Create a NY.gov ID

You’ll then be prompted to create a “NY.GOV” ID if you don’t already have one.

NOTE: I already had an ID from sometime in the past when I had to get a new driver’s license. Using that old account did not work, and I could not advance to the application screen. In trying to create a new account, however, using a different email address, I was able to get to the right screen (see below). Needless to say, you may need to try something similar.

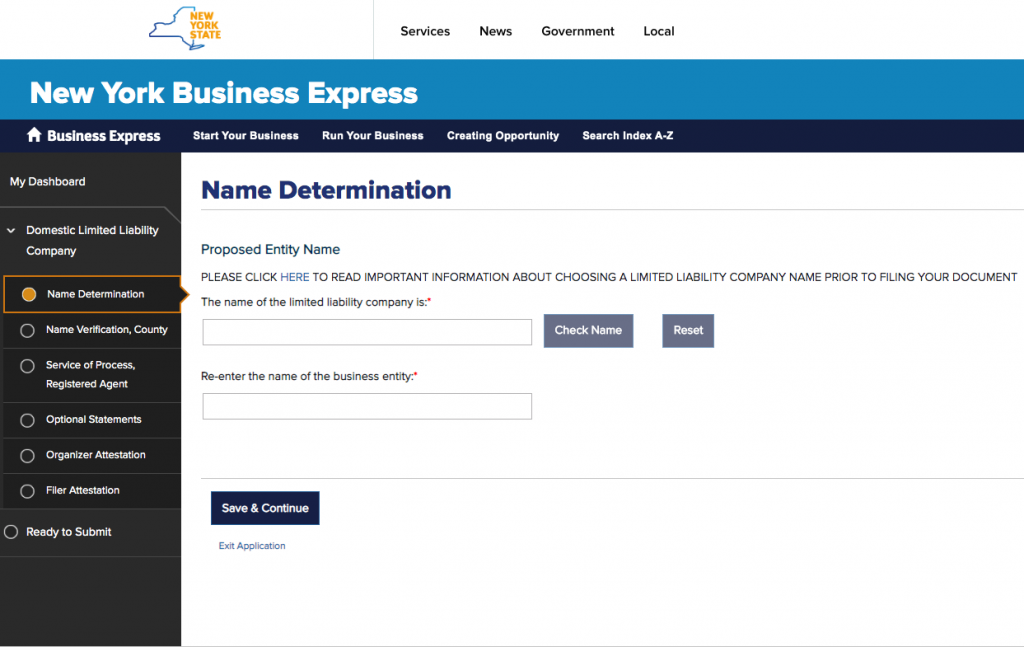

Step 6: Fill and sign

It will ask you for the name of your Limited Liability Company.

NOTE: that the name you enter must actually contain “Limited Liability Company”, “LLC”, or “L.L.C.” After you enter the name, click “continue” and the site will ask you for the following additional information:

- The county location of the LLC

- Designation for service or process

- Signature

- Filer

This is all the information that will go into the articles of organization.

NOTE: There are a bunch of “optional” checkboxes. They say optional because they are.

Step 7: Pay filing fee

At the end, you will be asked for a filing fee of $200 which you can pay by credit card. You will then receive a filing receipt.

NOTES: Do not lose this—It is what you will need to “publish notice” of your LLC. Also, I’ve been told that it’s a good idea to request a certified copy for your records for an additional $10.

Step 8: Publish notice

The next step is publishing notice of your LLC. You only need* to publish in the county where your principal office is located.

NOTES: If you’re based in Manhattan, you may want to think about alternative counties in the state to set up as your principal office as publication costs are much more expensive in New York County than anywhere else. You can always change the location of your principal office after publication at no cost. *There is legal precedent that publication is either completely unnecessary, or at least can be done retroactively when in a situation in which your LLC is involved in either side of a lawsuit. That said, for a few hundred dollars, is it worth rolling the dice?

An example of how to publish notice of your LLC in King’s County, NY (aka, Brooklyn):

Bring two photocopies of the filing receipt to the Kings County Clerk’s office. The Clerk’s office will assign two local newspapers (one daily and one weekly) in which to publish notice of the establishment of your LLC in New York. These can either be submitted in person to Window #2, or by mail which must contain a stamped, self addressed envelope.

If sending by mail, you can send to: The Kings County Clerk, Room 189, Window #2, 360 Adams Street Brooklyn, NY 11201.

See here for more detail. The publication will run for a period of 6 weeks. You may wish to call the Kings County Clerk’s office prior to filing to inquire about the cost at 347-404-9772.

NOTE: The law requires you to publish the articles of organization within 120 days after filing.

Step 9: Certificate of Publication

After publication, the publisher will provide you with an affidavit of publication. You must file the affidavit and a “Certificate of Publication” with the NY Department of State, Division of Corporations. Some publications will take care of this for you, but you’ll need to double check. Also, you’ll want to confirm that the filing fee is included in the publication fee.

Step 10: Operating Agreement

In New York, the member or members of a limited liability company are required by law to adopt an “Operating Agreement” within 90 days of formation (aka, the date of filing) of the limited liability company. The Operating Agreement governs the rights and responsibilities of the company’s members as well as the workings of the company. If there’s more than just one person forming this LLC (ie, partners or a small group), you probably will want to consult an attorney for this one or at least use LegalZoom or something similar. If it’s just you, you can probably get away with just Googling “free customizable operating agreement template”, and simply amending that. (Remember that disclaimer?) This is really only important when discussing partner responsibility and the plans for dissolving or growing the company with multiple owners.

NOTES: If you’ve got multiple owners, you may want to get your document notarized. You don’t actually need to do anything with this document; just make sure you file it away or make sure each owner has a copy.

Step 11 (Bonus): EIN

After your LLC is filed in New York, you will probably want to apply for an “EIN number” so you can file your taxes and open a business bank account. You can access and fill out the Form SS4 online application. Alternatively, you can access a PDF copy of the application that you can print and submit by mail or fax. You can call the IRS to request an EIN number at 1-800-829-4933 from 7:00 a.m. to 10:00 p.m., local time. Instructions for completing the Form SS4 and obtaining an EIN can be found on the IRS website.

And that’s pretty much it. Follow these 10 steps, and you should be able to file your LLC in New York. There’s a lot here and obviously a ton of steps, but while somewhat tedious, it isn’t all that tough and shouldn’t take more than an hour or so.

Once again, I am not an attorney. The information provided in this article and on this website does not, and is not intended to, constitute legal advice; instead, all information, content, and materials available here are for general informational purposes only. Information contained in this article may not constitute the most up-to-date legal or other information.

Readers of this article add website should contact their attorney to obtain advice with respect to any particular legal matter. No reader, user, or browser of this site should act or refrain from acting on the basis of information on this site without first seeking legal advice from counsel in their relevant jurisdiction. Only your individual attorney can provide assurances that the information contained herein – and your interpretation of it – is applicable or appropriate to your particular situation.

All liability with respect to actions taken or not taken based on the contents of this site are hereby expressly disclaimed. The content on this posting is provided “as is;” no representations are made that the content is error-free.

Pin this post!

Leave a Reply